Oh dear! Customer satisfaction has dropped this year, according to a survey done by the Institute of Service Excellence (ISES).

Reading various reports in The Straits Times, TODAY and Business Times, several sobering statistics await us:

Oh dear! Customer satisfaction has dropped this year, according to a survey done by the Institute of Service Excellence (ISES).

Reading various reports in The Straits Times, TODAY and Business Times, several sobering statistics await us:

What should we do when life throws us lemons? After all, we are living in a flawed world and are prone to anxieties, guilt, torment, depression, and all kinds of problems.

The answer, according to Pastor Joseph Prince, is to believe right. In his latest book, The Power of Right Believing, Prince teaches that “right believing always produces right living” and allows us to “let go of a life of defeat and step into a life full of victory, security, and success”. Focusing our thoughts on God’s love and mercy yields far better outcomes than believing in unhealthy emotions which lead to “toxic feelings of guilt, shame, condemnation, and fear” and ultimately negative behaviors, actions and addictions.

Let’s do a little quiz.

How many of you know who Lim Chin Siong or James Puthucheary were?

Or this formidable sounding dude called “The Plen”?

Stumped? Don’t worry. I was just as clueless.

Hopefully that will change with the re-launch of The Battle For Merger. Narrating how our first PM Lee Kuan Yew wrestled control for Singapore from communist insurgents, the book is published jointly by the National Archives of Singapore and Straits Times Press.

Brainchild of DPM Teo Chee Hean, the reprint of The Battle For Merger chronicled the series of radio broadcasts by former PM and Minister Mentor Lee Kuan Yew (LKY). Updated from the original edition published way back in 1962, it contains the transcripts of 12 radio talks written and delivered by Mr Lee between 13 September and 9 October 1961.

With Singapore property prices hitting stratospheric levels, many are inclined to look at the wider South East Asian region. After all, we do have a pretty strong Singapore dollar right now, and many Singaporeans are flush with cash.

Right now, residential properties in Makati, Manilla (Philippines), and the Iskandar region of Johor Bahru (Malaysia) appear to be the hottest ones in the market. Those who prefer to venture further afield are also considering properties in the white hot Melbourne and Sydney markets or even properties in the UK.

What about the island of Penang? Are Penang properties still worth investing in? Let us take a closer look.

Alvin Mark Yapp, Founder of The Intan; DPM Teo Chee Hean; Mr Koh Choon Hui (Chairman of Singapore Children’s Society) and Minister for Manpower Tan Chuan-Jin at Project Intan 2014 (courtesy of The Fat Farmer)

Alvin Mark Yapp is a man on a mission. Boss of outdoor advertising specialist Bus Ads, the Peranakan entrepreneur opens up his beautiful Peranakan-themed home every year to raise funds for the needy. And boy are his tireless efforts making waves!

What is the fastest growing yet often neglected consumer group? One that has contributed to a demographic bulge of about 77 million people in the US?

Yes, I’m talking about the Baby Boomers, i.e. those born from 1946 to 1964. Hitting their silver years over the next decade or so, Baby Boomers represent the largest age-related demographic group in the world today. In China alone, it is predicted that the 50+ marketplace will swell to a staggering 525.8 million people by 2025.

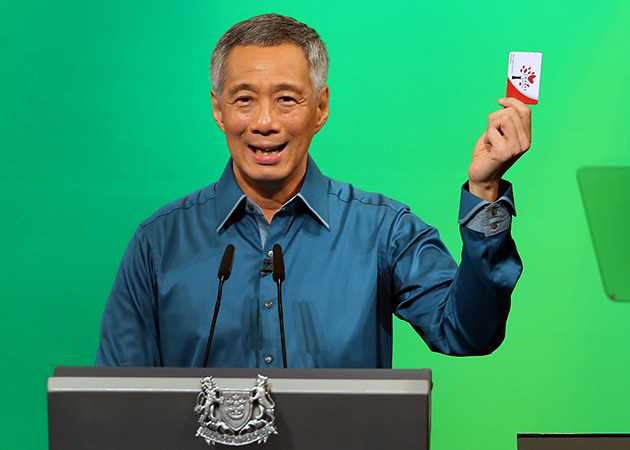

PM Lee at National Day Rally 2014 (courtesy of Prime Minister’s Office)

Prime Minister Lee Hsien Loong’s recent National Day Rally speech got me thinking about the challenges of planning for one’s retirement. Are Singaporeans aware of how much funds they need to retire comfortably? Do they know what their true retirement living costs will be?

I like how PM illustrated the case of a fictitious 54 year old senior technician named Mr Tan, and how his estimated living costs of $2,000 per month could possibly be met. Through the example given, PM showed that a CPF Minimum Sum of $155,000 – to be adjusted to $161,000 next year – isn’t an unreasonable amount to be considered in one’s Retirement Account (RA). In fact it can only cater to a very basic lifestyle and is probably insufficient for those who retire earlier (at say 55 rather than 65 years of age).

What do you get when you combine exquisitely prepared Italian cuisine with nature-inspired imagination?

Inspired by the ancient Greek word Gaea which means “Mother Earth”, Gaia Ristorante and Bar is located at the Goodwood Park Hotel. Infusing natural elements in the aesthetics of its decor and food, the venue houses a martini bar, dining rooms of various configurations and an inner courtyard dining room decked to resemble a garden. Lush and luxuriant, Gaia features plush leather booth seats, elegantly comfortable arm chairs and a glass-enclosed wine cellar cum private room that seats 10.

The June school holidays are here! What should frazzled fathers and manic mothers do?

Well, besides going for a holiday and taking a break after the mid-year exams (aka SA 1), we ought to also find ways to occupy our kids productively. As parents to a 10 year old boy in primary five, my wife and I are particularly concerned that our son should focus on filling in the gaps in his knowledge while still having a balanced holiday.

Johor Bahru (JB) can be fun for families who watch their budgets. With our rising Singapore dollar and the high costs of air travel (taxes and fuel surcharges particularly), there are more reasons than ever to consider a Malaysian holiday.

On a whim and a fancy, we hopped over to Johor Bahru (JB) when school closed last Wednesday. Like previous visits back in 2011 and 2013, we went via mostly buses and opted to go on a weekday.