Ever wonder why some people are a lot more successful than others?

How do these folks achieve peak performance in their fields? What do they do differently from the rest of us?

Ever wonder why some people are a lot more successful than others?

How do these folks achieve peak performance in their fields? What do they do differently from the rest of us?

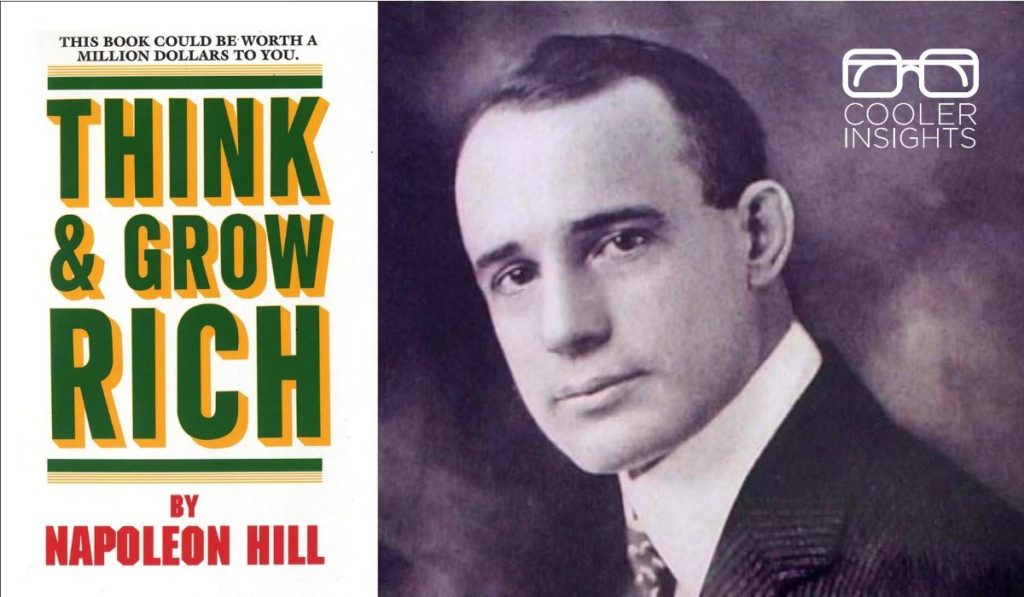

Can a book written over 80 years ago (1937 to be precise) still be relevant today?

The answer is a definite “Yes!” At least when it comes to Napoleon Hill’s widely cited volume Think and Grow Rich.

Courtesy of Mary Aiken

Mary Aiken (above) is a forensic cyberpsychologist.

A woman on a mission, she desires to change how we use emerging technology by explaining how it shapes our children and influences our behaviour and values.

Courtesy of The Legacy Project

“Let us pick up our books and our pens,” I said. “They are our most powerful weapons. One child, one teacher, one book and one pen can change the world.” – Malala Yousafzai

Malala Yousafzai is not your typical teenager.

While others her age were taking selfies of themselves on Instagram, or posted about the food they ate or outfits of the day they wore, Malala worked feverishly to change the destiny of millions of girls in South Asia, the Middle East and Africa.

Winner of the Noble Prize for Peace in 2014, Malala used her impressive skills in written and oratorical skills to stand up for children’s education. A member of the Pashtun tribe in the picturesque Swat Valley of Pakistan, her life story was truly remarkable.

Courtesy of TED Talks

What do courage and joy have in common? How do we live fuller and more wholehearted lives by daring greatly?

The answers to these questions and more were answered in Daring Greatly by storytelling researcher and psychologist Dr Brené Brown. Exploring the width and depth of how we live, love and engage with one another, Daring Greatly challenges us to defy the prevailing social climate of scarcity in order to live and love more wholeheartedly.

How do we escape the 9-5 shackles of corporate drudgery to build a life of adventure, meaning and purpose? Can we do this with $100 (or less) in our pocket?

The answer to both questions is yes. At least according to Chris Guillebeau, author of The $100 Startup.

Do you know that Dhoby Ghaut, which means “washing place”, got its name from dhobis or laundry men who plied their trade there?

Or that dead pigs could sometimes be seen floating along the river near Queenstown back in the 60s?

LEGO Star Wars Millennium Falcon – the most highly sought after toy for geeks! (source of image)

Everybody loves LEGO. Boys, girls, mums, dads, and construction toy geeks of all ages.

However, do you know that the world’s favourite toy building blocks is also a powerhouse of innovation?

Do you know that in 1795, French despot Napoleon Bonaparte offered 12,000 francs as a reward for a grand challenge to preserve food?

Or that Nike’s gamified platform Nike+ helped it to capture nearly 50% of the running shoe market?

Brendon Burchard (source of image)

What makes us truly alive in whatever we do? How can we lead lives brimming with energy, engagement and enthusiasm?

Enter The Charge. Subtitled “Activating the 10 Human Drives That Make You Feel Alive”, this easily read tome provides lots of fodder for anybody seeking to achieve more with life.